Transform your Lending business

RAHI's Core Lending platform, a single instance for all Retail and Commercial Lending Product’s lifecycle events of Acquisition, Servicing with Accounting & Debt Management with native Customer Digital Engagement for use by all User constituents – Employee, Outsourced Staff, Partner & Customers.

Functional Architecture

Lending Lifecycle Capabilities

Enterprise Customer management

UCIC (Unique Customer Identification Code) for a single unified Customer profile with consolidated information enabled by a strong “De-dup” engine to deliver Unified Customer view across all relationships.

UCIC (Unique Customer Identification Code) for a single unified Customer profile with consolidated information enabled by a strong “De-dup” engine to deliver Unified Customer view across all relationships.

Flexible Product & Fee Configuration

Create and launch multiple retail & commercial loan products with hierarchy (Portfolio – Product – Scheme), multiple interest rate types (Fixed, Index-linked, Hybrid), Repayment variations (moratorium, advance instalments, balloon, bullet, step-up/down) and amortization methods (Reducing Balance, Flat Method, and Equated Installments) along with Comprehensive configuration of all multiple Fee Structures and Charges with Tax and GST compliance.

Create and launch multiple retail & commercial loan products with hierarchy (Portfolio – Product – Scheme), multiple interest rate types (Fixed, Index-linked, Hybrid), Repayment variations (moratorium, advance instalments, balloon, bullet, step-up/down) and amortization methods (Reducing Balance, Flat Method, and Equated Installments) along with Comprehensive configuration of all multiple Fee Structures and Charges with Tax and GST compliance.

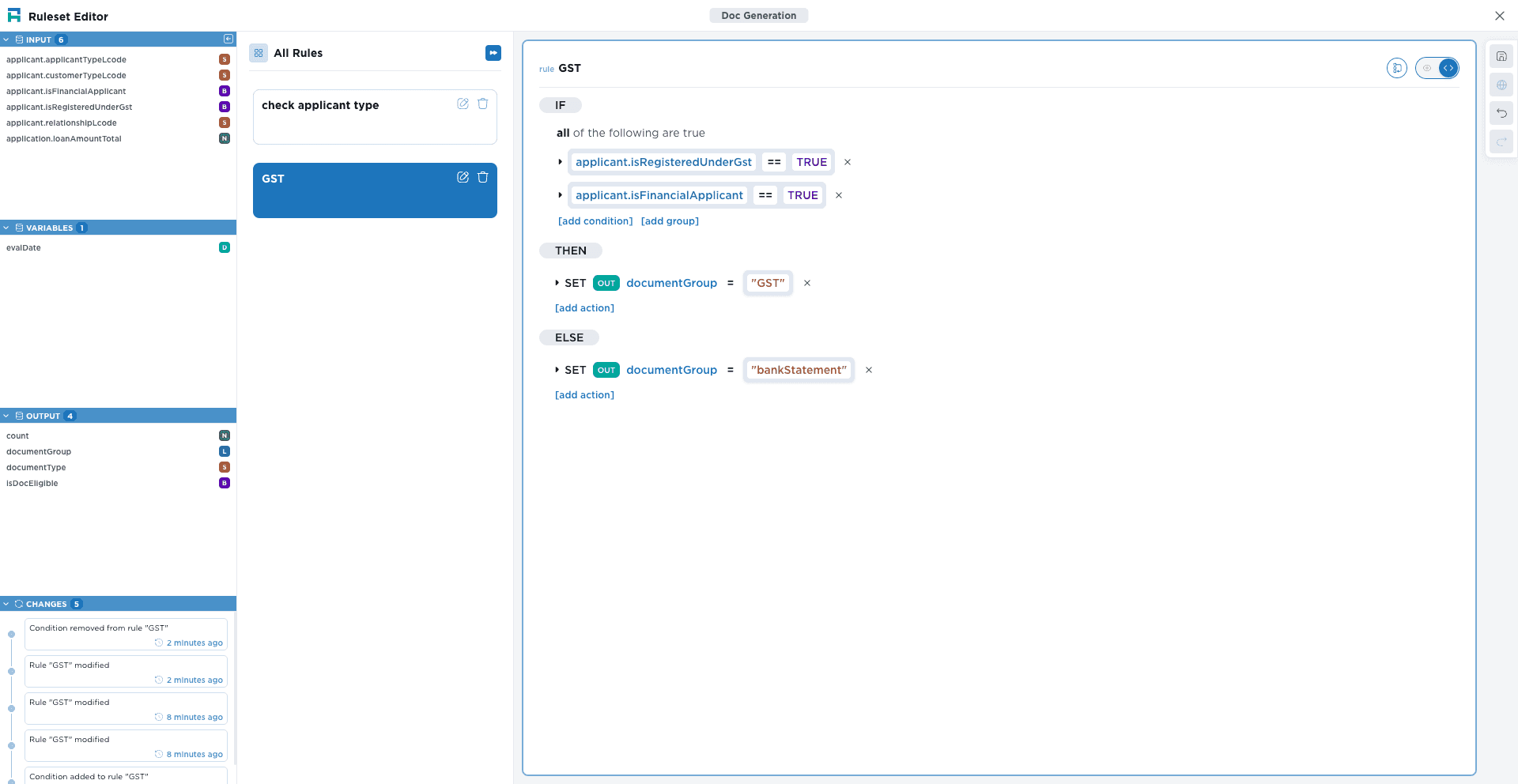

Business Rule Configuration

Configure complex Business rules to implement Risk policies, Deviation authorizations, Document & Verification checklists, Product Eligibility criteria’s along with flexibility to configure Formulae’s & Expressions across all Data model attributes.

Configure complex Business rules to implement Risk policies, Deviation authorizations, Document & Verification checklists, Product Eligibility criteria’s along with flexibility to configure Formulae’s & Expressions across all Data model attributes.

Customer communication and notification

Real-time communication of pre-configured templates for E-Mail / SMS basis Life-cycle stages and events.

Real-time communication of pre-configured templates for E-Mail / SMS basis Life-cycle stages and events.

Multi-layered Organisation Geo & User Role configuration

Configure multi-tiered Geo structure of the Organisation (Branch, Region, Zones etc.) along with Users Roles for base Branch & Portfolio with multi-tiered User hierarchy levels.

Configure multi-tiered Geo structure of the Organisation (Branch, Region, Zones etc.) along with Users Roles for base Branch & Portfolio with multi-tiered User hierarchy levels.

Embedded Workflow Orchestration & Allocation

Implement intricate lending workflows - parallel processing, conditional branches & exception handling without coding require. Enables Lender to quickly implement changes in Business processes & User – Role based allocation.

Implement intricate lending workflows - parallel processing, conditional branches & exception handling without coding require. Enables Lender to quickly implement changes in Business processes & User – Role based allocation.

User Interface Configurator

Native UI configuration tool to quickly deliver changes in information capturing, conditional fields, smart validations & responsive layouts.

Native UI configuration tool to quickly deliver changes in information capturing, conditional fields, smart validations & responsive layouts.

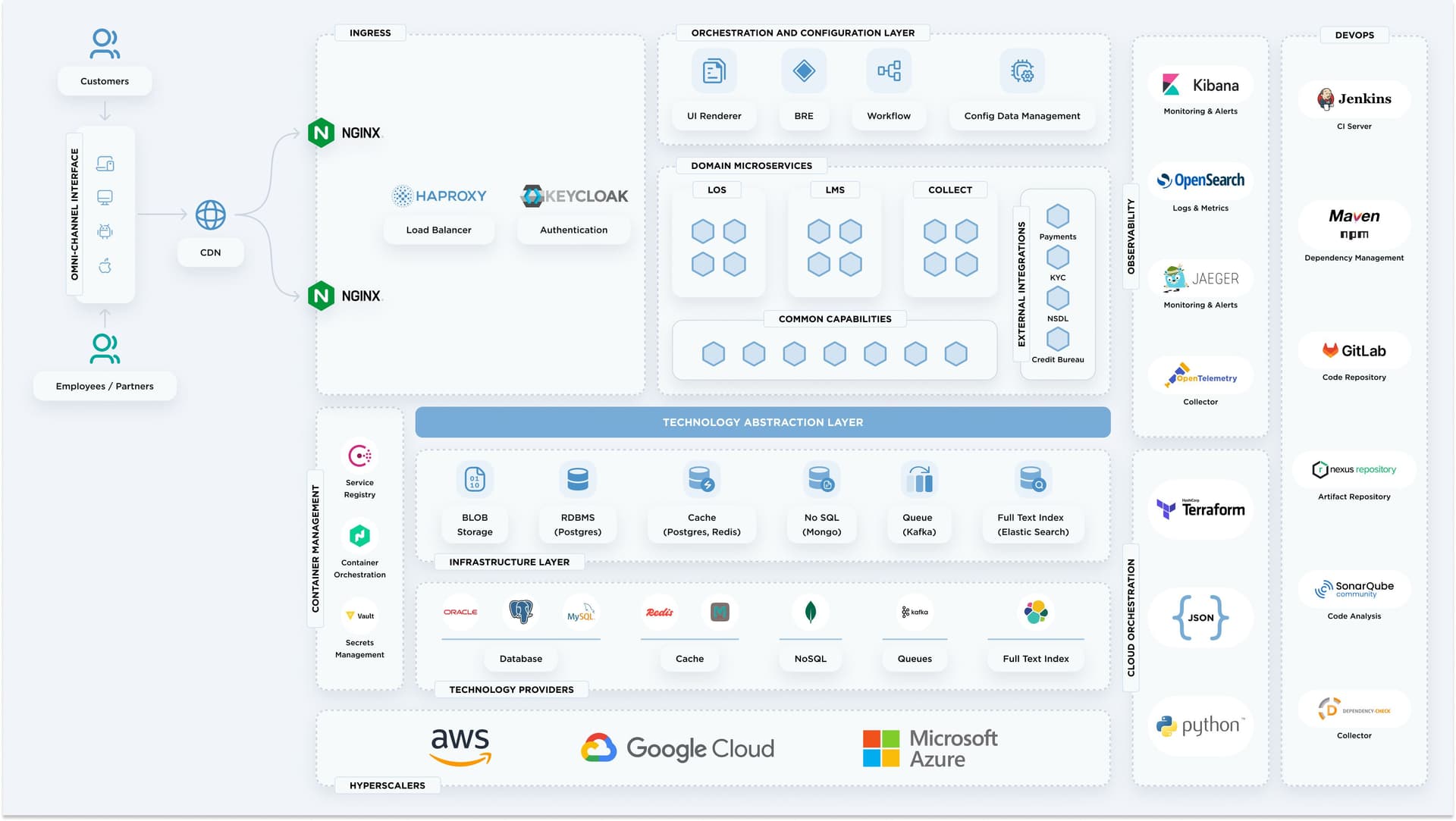

Technology Architecture

Technology Differentiators

Configuration-First Architecture

Business users configure products, workflows, and rules visually - no coding required, no development bottlenecks, long and complex customisations.

Your Challenge

Traditional lending platforms trap business innovation behind IT change cycles, turning simple rule changes into months-long development projects. Our three-tier configuration system puts product managers in direct control of lending workflows, underwriting criteria, and user interfaces through intuitive visual tools. Launch new products in days, change to business expectations instantly, and A/B strategies without consuming technical resources.

Unified Omni-Channel Experience

One platform power every customer touchpoint - mobile, web, call center, field force, partner channels - with consistent logic and seamless experience switching with same workflows.

Your Challenge

While traditionally people build separate applications for each customer touchpoint, our unified solution serves all channels through a single API stack. Customers start applications on mobile, continue on web, and complete over phone without losing data or restarting processes. This eliminates the expensive multi-channel development that typically doubles implementation costs while delivering the consistent, modern experience today's customers expect across every interaction.

Modular Product Independence

Deploy only what you need - LOS, LMS, or Collections independently - then expand seamlessly without system overhauls or vendor lock-in.

Your Challenge

Monolithic lending platforms force expensive all-or-nothing purchases, but our modular architecture lets you start with specific capabilities and expand organically. Implement loan origination without needing collections, or add servicing capabilities years later without system rewrites. Each module operates independently while sharing common infrastructure, giving you the flexibility to build your technology stack around your business strategy and integrate with existing solutions.

Pluggable Integration Architecture

Connect any fintech partner through configuration, not custom code - credit bureaus, fraud detection, verification services deploy in minutes.

Your Challenge

Legacy systems make fintech partnerships a long integration nightmare, forcing lenders to abandon valuable relationships due to technical constraints. Our configuration-based API framework includes pre-built connectors for major credit bureaus and standardized plugins for emerging fintechs. Deploy new partnerships without system downtime, access alternative data sources instantly, and stay current with fintech innovation. Your technology should expand your partnership opportunities, not limit them.

Framework Abstraction & Technology Independence

Future-proof technology stack through framework abstraction—swap databases, messaging systems, or cloud services without application rewrites.

Your Challenge

Traditional platforms hard-code technology dependencies, making upgrades expensive and forcing obsolete technology choices for years. Our framework abstraction layers separate business logic from underlying technologies, enabling seamless evolution of your tech stack. Migrate from Redis to alternative caching, upgrade databases, or adopt new messaging systems without touching application code. Your lending platform should leverage tomorrow's innovations, not trap you in yesterday's technology decisions forever.

Cloud-Agnostic Multi-Tenant Architecture

Deploy on any cloud - AWS, Azure, Google, or private - without vendor lock-in, with full multi-tenant efficiency and security.

Your Challenge

Cloud vendor lock-in costs you negotiating power and limits compliance options, while single-tenant architectures waste resources and increase costs. Our cloud-agnostic design works identically across all major providers, giving you leverage in cloud strategy and flexibility for regulatory requirements. Multi-tenant architecture maximizes resource efficiency while maintaining enterprise-grade security and data isolation. Our highest-grade open source cloud stack prevents vendor lock in and enables very high-cost efficiency with options to use cloud provider's PaaS solutions.

Why Choose RAHI Core Lending Platform?

Single Instance

Unified Lending

Future Ready

100% Open Source

Lower TCO

Smart Automation

Transform the Way You do Business

Schedule Demo

Capability & Architecture Details

RAHI CLP ensures omni-channel consistency through a unified API and orchestration layer that powers every touchpoint — mobile, web, call center, field force, and partner portals. Core workflows, rules, and product logic run on a single stack with centrally synchronized states, allowing customers to move seamlessly across channels without losing progress. This unified approach eliminates duplicate logic, ensures consistent decisioning and compliance, and reduces maintenance overhead across LOS, LMS, and Collections.

Yes. RAHI CLP is built with Modular Product Independence, allowing LOS, LMS, and Collections to run as standalone services while sharing the same orchestration, tenant management, and security frameworks. Each module can be deployed independently, with prebuilt interconnects for seamless handoffs between them and standardized APIs for external integrations. This gives lenders the flexibility to start with what they need today and expand later without costly rework or complex integrations.

RAHI CLP uses a Pluggable Integration Architecture with abstraction and translation layers that standardize vendor APIs into a common contract. This allows lenders to plug in credit bureaus, KYC providers, fraud detection, payments, or alternative data sources without code rewrites. With prebuilt connectors, standardized APIs, and config-driven deployment through JSON DSLs, new vendors can be onboarded or swapped in quickly. This design makes CLP future-proof against fintech churn, enabling lenders to expand their ecosystem without costly integration projects or vendor lock-in.

RAHI CLP avoids lock-in through a Framework Abstraction Layer that decouples business logic from infrastructure services. This tenant-aware layer centralizes scaling and isolation, making it easy to adopt new databases, caches, or messaging systems without rewriting code. Governance for compliance, monitoring, and security is enforced at this single layer, ensuring consistency across tenants and modules. By separating applications from underlying technologies, CLP stays future-ready, vendor-agnostic, and governed at a single control point.

RAHI CLP is Cloud-Agnostic by design, delivering identical behavior on AWS, Azure, GCP, or private cloud. Instead of relying on provider-native tools, it uses the open-source HashiCorp stack (Terraform, Vault, Consul, Nomad) for orchestration and management. Deployments are defined through JSON-based DSL blueprints, ensuring repeatability and eliminating configuration drift, while immutable infrastructure enforces clean, reliable environments. This approach gives lenders full control of their cloud strategy, avoiding dependency on any single provider and enabling future-ready flexibility.

Yes. RAHI CLP is engineered for scalability and resilience, ensuring consistent performance even during peak workloads. Built on microservices with horizontal scaling, only the services under load are scaled, not the entire platform. Resources are sized declaratively through JSON DSL blueprints, making scaling predictable and repeatable. With event-driven batch processing, workloads can be managed at granular levels — per LAN or per application — ensuring backpressure is absorbed intelligently. This design sustains high concurrency, large batch volumes, and real-time peaks while maintaining stability and cost efficiency.

RAHI CLP is built with resiliency at its core, ensuring uninterrupted operations even during failures. Services are designed to be stateless and load-balanced, while critical data is stored in distributed and replicated systems for seamless recovery. Core components run in clustered deployments with automatic failover, and multi-zone awareness safeguards against localized disruptions. Together, these mechanisms deliver high availability, fault tolerance, and consistent service continuity across all tenants and modules.

RAHI CLP embeds observability by design, enabling every transaction and workflow to be traced, monitored, and analyzed end-to-end. All services are instrumented with OpenTelemetry, with Jaeger providing distributed tracing, Elasticsearch powering log analytics, and Kibana delivering real-time dashboards. This open-source observability stack ensures transparent monitoring, faster root-cause analysis, and data-driven operational governance across tenants and modules.

RAHI CLP embeds compliance-by-design, enabling lenders to meet evolving regulatory, supervisory, and data protection requirements without custom builds. Compliance rules, disclosures, and obligations are modeled declaratively, with native support for data protection, consent management, and automated Key Fact Statement (KFS) generation. Multi-tenant design enforces data residency and isolation, while centralized audit trails ensure regulatory-grade transparency. By integrating privacy, consent, and compliance into workflows, CLP keeps institutions aligned with current and future mandates while retaining agility.

RAHI CLP is built on a Zero Trust security model, where every user, service, and request is continuously verified and authorized. Identity is managed centrally through Keycloak with SSO, MFA, and standards-based authentication. RBAC and ABAC policies enforce least-privilege access across technical and business roles, all within a multi-tenant aware framework. Sensitive data and credentials are protected with encryption and Vault-based secrets management, while continuous verification and tamper-proof audit logs ensure compliance and prevent privilege escalation.

RAHI CLP is built on an open-source–first foundation, eliminating proprietary licensing costs and ensuring freedom from vendor lock-in. Declarative orchestration and multi-tenant design optimize infrastructure usage, while prebuilt connectors and configuration-driven workflows cut integration and maintenance expenses. Built-in observability with OpenTelemetry, Jaeger, Elasticsearch, and Kibana reduces downtime and support costs. Together, these design choices deliver a sustainably low total cost of ownership while keeping the platform scalable and future-ready.